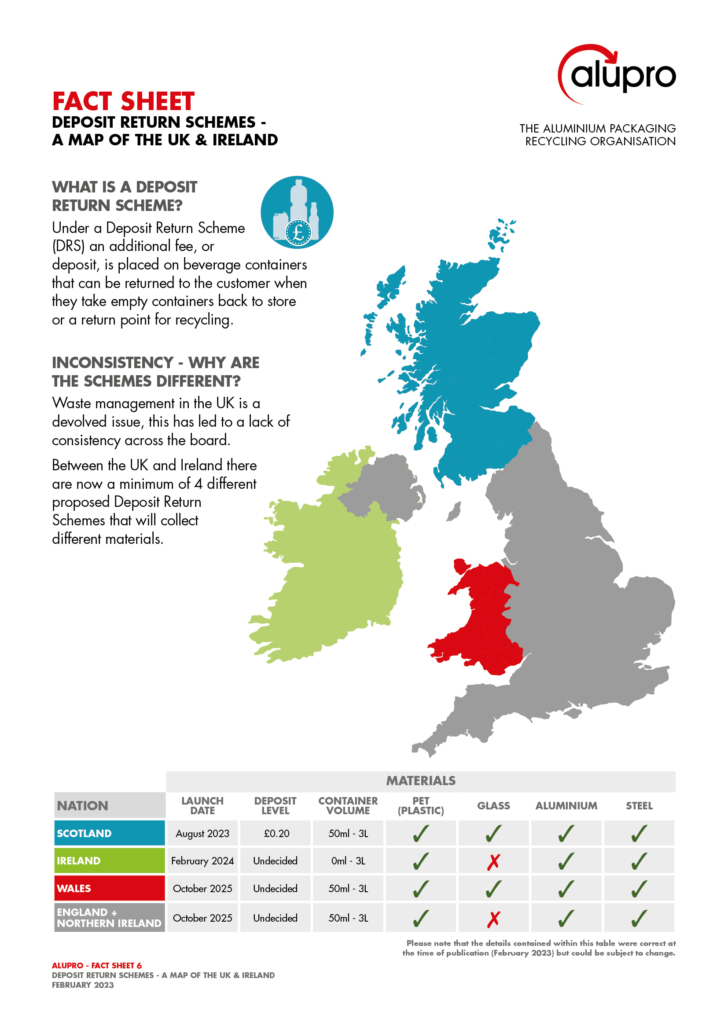

Whilst we are supportive of a Deposit Return Scheme (DRS) in the UK, we were concerned that a DRS with a flat deposit amount for all containers, regardless of size or material, would lead to switching from multipacks of aluminium cans to larger format plastic bottles due to the cumulative cost of the deposit fee on multipacks.

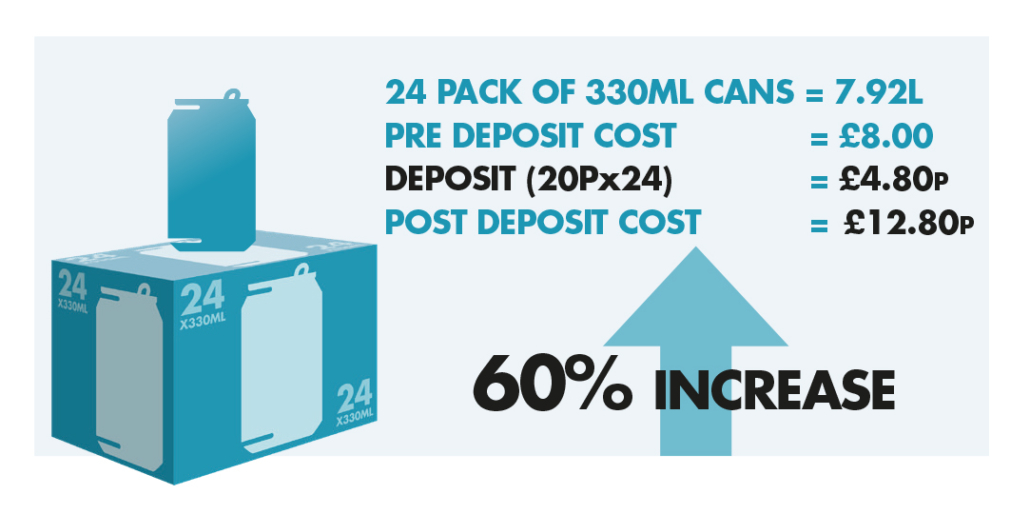

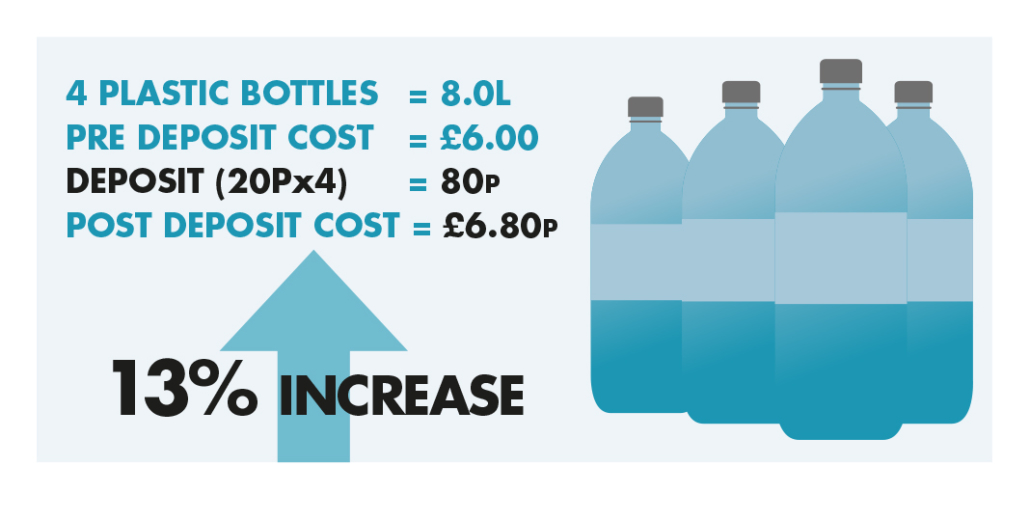

For example, a 20p flat deposit fee adds £4.80 to a 24 pack of cans, yet the deposit for the same volume in 4 plastic bottles is just 80p. A 2019 poll of consumers found a 20p flat deposit fee would encourage over 60% of individuals to switch to large PET bottles at the expense of the infinitely recyclable aluminium can. We were concerned about the negative impact this could have on the environment, financing of a DRS, public health, and the use of aluminium, which is infinitely recyclable.

Due to the very limited research on the impact of a variable vs flat deposit fees on consumers’ choice of packaging materials, Alupro commissioned London Economics, a leading research consultancy, to conduct rigorous research into consumer behaviour, the different impacts of a flat or variable rate in the UK, and examined the economic, environmental, and public health consequences.

We think the most important findings are that:

- A variable rate, as used in the successful Nordic schemes, will deliver significantly higher return rates in the first two years of operation.

- A DRS is cheaper to run using a variable rate as there will be higher revenues from unredeemed deposits and recyclates.

- A variable rate has a lower financial burden on producers as product fees can be set lower.

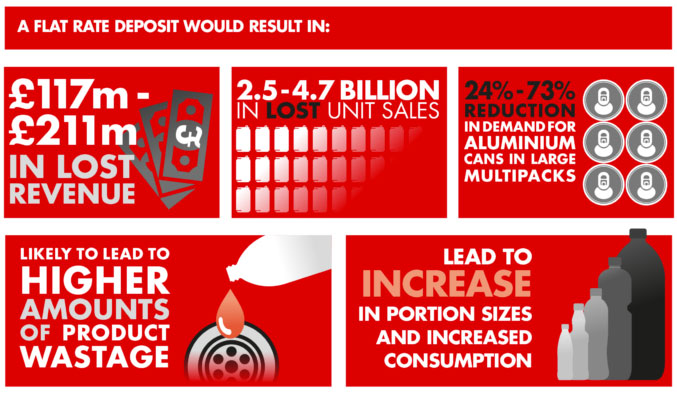

- A flat rate could lead to higher amounts of product wastage and increased portion sizes.

- Compared to a variable rate system, a flat rate deposit would have a dramatic impact on the aluminium packaging sector, meaning 5 – 4.7 billion less cans sold, £117- £211m less revenue, and a 24% – 73% reduction in demand for aluminium cans in large multipacks.